Entering of 2018 means that we are one step forward in witnessing the commercial use of 5G. In 2017, 5G was absolutely a hot topic in the communications industry: Relevant standards, technologies, and layers made progress in several areas, mainstream vendors successively launched their pre-commercial products, and certain carriers actively carried out field tests. At the end of 2017, the first 5G standard was frozen, and 30 industry-leading companies jointly announced that they supported this standard unification, which further promoted a peak in enthusiasm for 5G. As scheduled by 3GPP, its first 5G standard (R15) will be officially released in June 2018. Vendors will begin to launch commercial products in the second half of the same year in order to make final preparations for large-scale commercial use.

It has been proven that 5G is a deterministic opportunity. The China Academy of Information and Communications Technology (CAICT) predicts that, by 2030, 5G will bring about a direct economic output of 6.3 trillion yuan, an economic added value of 2.9 trillion yuan, and eight million job opportunities. 5G will also bring about an approximate total output of 10.6 trillion yuan, an economic added value of 3.6 trillion yuan, and 11.5 million job opportunities as indirect contributions.

It can be said that 5G is waiting to be tapped by every industry in the next decade or more. Chinese vendors have already taken a leading role in technological innovation, standard formulation, and industrial partnership of 5G. Especially ZTE and Huawei are leading industry development trends in different fields from the perspective of innovation and product technology competitiveness. Some renowned consultancies have also spontaneously given a positive assessment regarding ZTE's recent performance in both 4G and 5G fields. This article explores ZTE's endeavors that help it seize the deterministic opportunities.

Precautions and Preparations

Compared with 3G or 4G, 5G is widely recognized more as an industrial revolution greatly impacting social development instead of only a technical upgrade in wireless communications. Therefore, 5G research is very extensive, and communication vendors play a key role in the promotion of the entire industry. ZTE put forward the “Leading 5G Innovations” slogan and started 5G pre-research very early: It has been increasing investments since 2015, with a budget of more than 3 billion yuan each year.

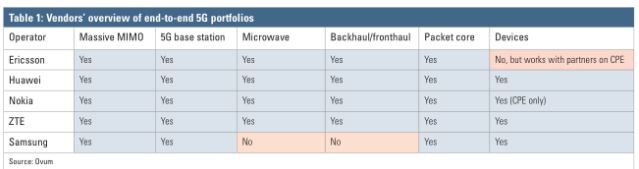

The latest report released by Ovum, an internationally renowned consultancy, shows that only ZTE and Huawei in the strictest sense can provide complete 5G end-to-end solutions regarding the Massive MIMO technology, gNB series, microwaves, fronthaul or backhaul, core networks, and terminals.

“Having an end-to-end solution helps a vendor communicate that it has deep understanding of the demands of 5G throughout the entire network and not just part of it.”, commented Ovum.

As for the products, ZTE is far ahead in the commercial process of the Massive MIMO technology intended to increase spectrum efficiency, and has taken the lead in applying this technology to the 4G networks worldwide. This lays a solid technological and commercial foundation for ZTE's first-mover advantages in 5G. ZTE was the first to release the 5G Flexhaul solution in February 2017. It also released ZXCTN 609 in June of the same year, and then released ZXCTN 6700 in the following September. Orienting integrated fronthaul and backhaul technologies, the ZTE 5G Flexhaul solution is developed on the basis of the first innovative FlexE Tunnel technology in the industry. The lowest latency and the lowest switching time are supported, thus effectively coping with 5G uRLLC challenges.

Leadership After Profound Technological Accumulation

Thanks to great endeavors made in 5G and continuous innovation in wireless communications, ZTE completed 5G-related technological and product solution accumulation in 2017. The development of communication technologies is definitely not a quantum leap, and market progress is highly reliant on technological accumulation. Therefore, the vendors who cannot keep up with technological evolution in 2G/3G and 4G/5G will be gradually forced to exit the stage. Currently, the remaining vendors with worldwide market competitiveness are ZTE, Huawei, Nokia, and Ericsson.

ZTE has been growing all the time: a follower in 2G, a pioneer in 3G, a competitor in 4G, and then a leader in 5G. In the 4G field, ZTE has already made remarkable achievements after profound technological accumulation, gaining high recognition from the world's mainstream carriers and industry-leading consultancies. The total shipments are almost one fifth of the global market. A Gartner LTE Magic Quadrant report shows that ZTE has been named as a leader from 2016. The LTE product rating report released by GlobalData in June 2017 rated ZTE LTE eNodeBs as the sole leader in the industry, and regarded them as the ones that are superior to others in terms of cell capacity and user capacity.

The continuous innovation and accumulation in 4G turn out to be a profound foundation for ZTE to become a leader in 5G. Michael Howard, a renowned analyst in IHS, thinks that ZTE has become a worldwide mainstream supplier mastering the cutting-edge TDD and FDD technologies (including Pre5G Massive MIMO) in the 4G LTE era. He said, “For 5G, I see ZTE growing as a leading mobile supplier with industry contributions and cooperation across many standards groups and more technology innovations.”

Embrace Open-Source to Build a Promising Future

Industry-leading consultancies also give very positive assessments in terms of the achievements that ZTE has made in the virtualization field. GlobalData's latest “Standalone VNF Managers: Competitive Landscape Assessment” report regarding independent VNFM assessment shows that ZTE CloudStudio VNFM products are rated as a “Leader” in the industry. At the same time, a virtualization report released by IDC in 2017 shows that, as a traditional telecom device and service provider, ZTE has strong telecom cloud infrastructure and suited service integration capabilities, and accumulates much experience in the deployment of large-scale vEPC, vIMS, and vSDM networks. The report also shows that ZTE has taken the lead in launching the automatic telecom-grade DevOps platform in the industry, and therefore becomes both a leader in the commercial use of NFV and an enabler in the digital transformation of CSPs.

Besides this, ZTE is also one of the suppliers who are most actively embracing open-source technologies, and has made great contribution to many open-source projects such as OpenStack. This in turn accelerates the R&D process of ZTE products.

Looking back upon 2017, we know that ZTE's leadership role in 5G complements a significant increase of China's national power and the strong elevation of the Chinese government and its industries in the 5G field. China is the world's first country that has completed field tests and industry planning led by the government. Currently, the second phase of China's 5G test has successfully been completed, and many performance measurements of ZTE products surpass industry standards. The Chinese government has set a policy to build the world's largest commercial 5G network, and is the first to announce 5G frequency bands, giving a very positive signal. In terms of markets, the Chinese market is sufficiently large, and global industry partners are willing to further explore the commercial requirements of 5G and create 5G end-to-end industrial chains by focusing on this market (from systems, terminals, to chips). In this way, the whole world can share the industrial advantages brought by economies of scale of China's 5G network.